CCLP’s 2024 legislative wrap-up, part 1

CCLP testifies in opposition of a state income tax reduction

Recap: Special Legislative Session 2023

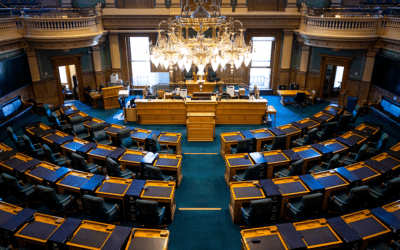

In the aftermath of the 2023 November election and the failure of Proposition HH, Colorado Governor Jared Polis called a special session of the Colorado General Assembly, held from November 17 to November 20. Over the course of a fast-paced and grueling weekend of...

Your CCLP guide to Proposition HH

2023 Legislative Review, Part 1: Housing and Income

Who gets the tax breaks in the 2023 Colorado Legislature?

Colorado is in a very odd situation. Our legislators can’t raise taxes due to TABOR (Taxpayer Bill of Rights). Those are decisions left to voters, who often favor only the taxes they themselves do not pay. On the other hand, both the voters and legislators can cut...

CCLP Opposes Proposition 121: State Income Tax Rate Reduction Grows Inequities

CCLP STRONGLY OPPOSES Proposition 121, which would permanently reduce the state income tax rate for individuals and corporations from 4.55% to 4.40%. This decrease would reduce state revenues by almost $400 million per year. If state revenues fall too far below the...

Income & Self-Sufficiency Policy Forum Recap, Part 1: The Self-Sufficiency Standard and barriers to self-sufficiency

At the beginning of September, CCLP hosted its second Policy Forum series event on Income and the Self-Sufficiency Standard in Colorado. We are grateful to those who were able to join us in conversation. Attendees raised important questions about the income trends as...

2022 Legislative Wrap-Up

This year’s legislative session has been an intense one to say the least, but with many positive results for Coloradans experiencing poverty. Major priority bills required research, testimony and support from CCLP — as well as our partner organizations, and our...