A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

How Colorado’s largest subprime lender has raised the cost of borrowing

In the final frenzied days of the 2015 legislative session, legislators passed a bill raising interest rates on Colorado borrowers accessing certain types of credit. Policymakers were persuaded by the industry sponsor’s story line: an interest rate hike is needed to expand credit to Colorado borrowers and lenders need the increase to meet their growing operating costs.

The bill’s primary advocate was OneMain Financial, the largest subprime installment lender in the nation. With 1,800 branches in 44 states, OneMain is by far the biggest fish in Colorado’s subprime lending sector. The company offers loans to borrowers with subprime credit. OneMain loans average about $6,000 with a repayment period of 3 to 6 years and an average annual interest rate of around 26 percent.

These loans can be deceptively expensive for borrowers. And if OneMain has its way, Coloradans will pay even more to borrow. Advocacy groups led by the Bell Policy Center and joined by CCLP, successfully persuaded Gov. John Hickenlooper to veto the 2015 bill that would have increased costs on an average $6,000 loan by 38 percent. Undeterred, OneMain returned in the 2016 legislative session with a slightly retooled proposal to raise interest rates on Colorado borrowers. The bill passed the Senate but was quickly defeated in the House.

In recent years, OneMain has emerged as a subprime powerhouse. Part of that impressive growth is due to OneMain’s concerted strategy to push for legislation in state legislatures to raise costs on subprime borrowers—who are already paying some of the highest interest rates in the country outside of payday lending. Since 2012, at least 10 states have been persuaded to raise the costs on these loans at a time when interest rates are at historical lows.

To better understand the terms of these loans and the implications for Colorado borrowers, the Colorado Center on Law & Policy reviewed collection cases filed by OneMain against delinquent borrowers in Denver County Court.

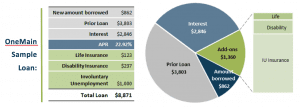

Our findings reveal how, despite their failed legislative efforts to date, OneMain found another way to make Colorado borrowers pay more. OneMain loans are commonly padded with expensive, low-value credit insurance products sold by insurance companies owned by OneMain. The company receives a commission on the sale of the insurance, the premium payment is financed in the loan so they also collect interest on the payment and the credit insurance ultimately protects the lender from the risk of default, not the borrower.

Among the findings detailed in our new report, Paying More To Borrow:

- Loans are padded with expensive insurance products. Three-quarters of the loans examined included expensive credit and non-credit insurance policies rolled into the loan amount. These borrowers saw the total cost of their loan raised on average by $1,200 or an 18 percent increase in the total loan cost.

- High-cost, low-value insurance. OneMain owns the two insurance companies that write insurance policies for their borrowers. And the loss ratios for the policies sold by OneMain—the percent of premiums paid out in claims—falls well below industry standards.

- Insurance that is voluntary in name but predatory in nature? Nearly 8 in 10 borrowers in Denver County Court collection cases agreeing to purchase this high-cost, low-value insurance, begs the question of how OneMain achieves such a high penetration rate if purchasing insurance was actually presented as a voluntary option. On average 2.3 insurance policies were sold for every loan made.

- Repeat refinancing means repeat customers and more profits. Nearly half of the cases we examined included a prior loan with OneMain; three-quarters of those renewals included insurance products rolled into the loan balance increasing the amount financed by an average of $720. Nationally, about 60 percent of OneMain loans are renewals of existing loans, a practice referred to as “default masking.”

- Default judgment often leads to wage garnishment and bankruptcy. Over half of the Denver County cases resulted in an order for wage garnishment. Colorado law does little to protect low-wage debtors from having to turn over a significant amount of their earnings for garnishment. Over 40 percent of borrowers filed for bankruptcy at some point and the vast majority of those bankruptcy filings occurred after the OneMain collection case was filed.

State lawmakers, regulators and consumer advocates must keep careful watch to ensure that consumers are not unwittingly paying for insurance products they don’t need and incurring debt they cannot pay.

– By Michelle Webster