A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

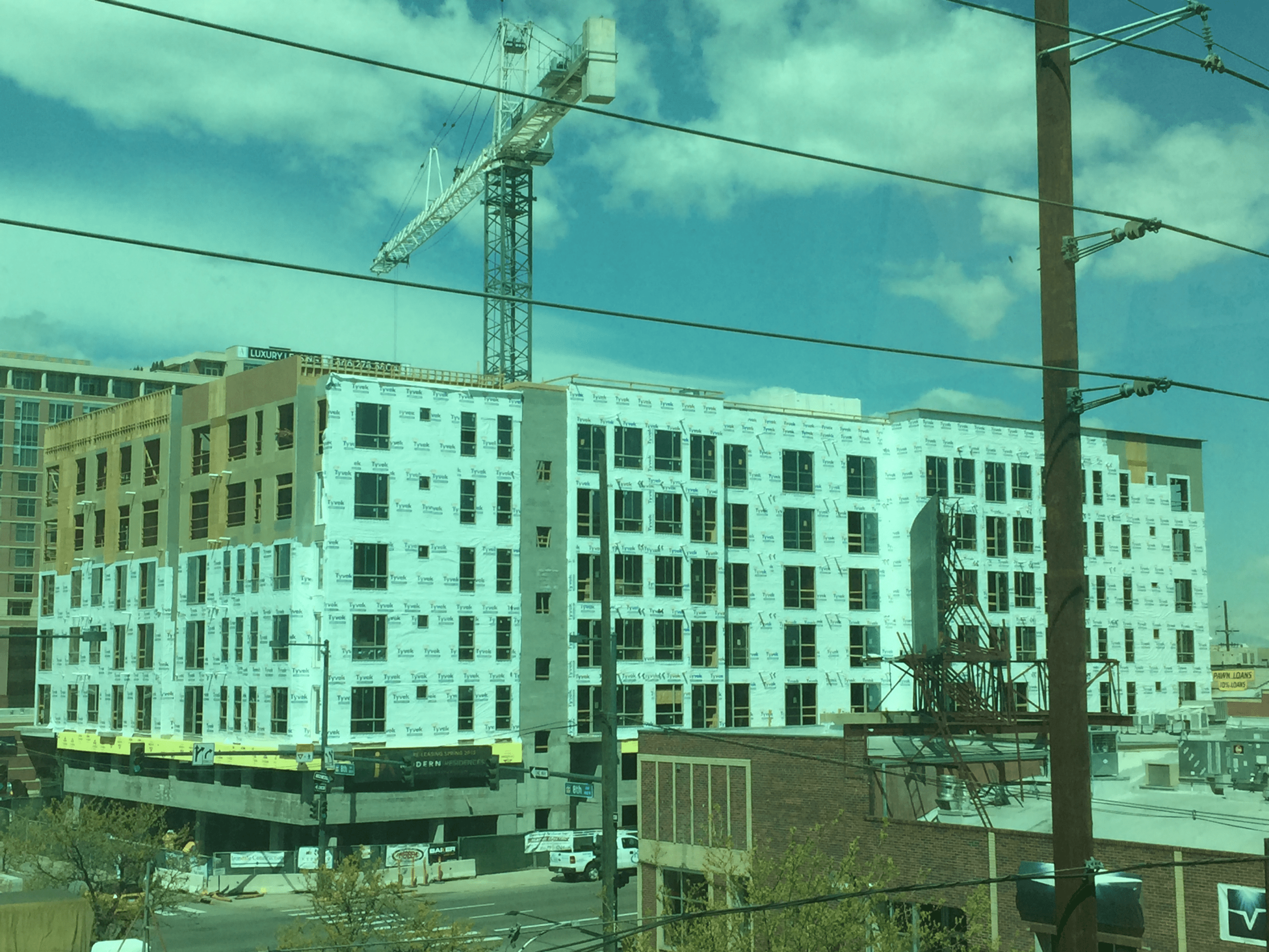

TABOR stymies efforts to increase affordable housing

Most of us agree that shelter ranks very high on the list of basic needs, along with food and water. Empirical evidence shows that investing in safe and affordable housing improves health, school achievement, and employment stability.

Yet, while shelter is clearly among the most basic of basic needs, Colorado is in the midst of a serious (and growing) affordable housing crisis. For many people housing consumes the majority of their income, pushing them to the brink of homelessness or forcing them to skimp on food and medicine in order to pay their rent.

Consider these numbers:

* Since 2007, average rent in Colorado has increased by 21 percent while income for the median renter household has only increased by 1.1 percent.

* The estimated average wage for a renter is $15.43 an hour—well below the hourly wage of $19.89 an hour needed to afford the Fair Market Rent of a two-bedroom apartment in Colorado.

* An estimated 164,600 households in Colorado pay more than half of their monthly income on rent. One-third of those households consist of elderly or disabled residents and 35 percent are families with children.

Recognizing that public funds are a critical component to creating affordable housing, CCLP has been working to introduce legislation during the 2016 session that would dedicate new funds towards construction and preservation of affordable housing and rental assistance for some of Colorado’s most challenged low-income residents. Unfortunately, the constitutional amendment commonly known as the Taxpayers Bill of Rights (or TABOR) makes it nearly impossible to inject new funding into the state budget to help finance construction of affordable housing, even when those funds don’t come out of taxpayers’ pockets or require a decrease in funding for other essential services.

Some background on the Unclaimed Property Trust Fund (UPTF): Since 1987, financial institutions, life insurance companies, and a host of other entities that hold other people’s money, have been required to turn those funds over to the state treasurer after they are deemed abandoned; that is, when there has been no activity on the account for a certain period of time and the holder has been unable to locate the owner despite repeated efforts. The state keeps those funds until the owner steps forward to claim them. Every year, the state Treasurer receives about three times more than it pays in claims, and there is a balance of over $200 million in the fund, which is growing by about $11 million a year.

In 2016, the Treasurer will require a reserve of over $115 million in the UPTF in case there is a flood of claims. Even so, this year’s balance of $85 million could be put to use addressing pressing problems without compromising the Treasurer’s ability to reunite people with their lost funds. Indeed, $35 million per year has been used in the past for Colorado’s high-risk insurance program and about $30 million per year is now being used to provide dental care to people on Medicaid.

CCLP’s legislation was originally designed to draw down a portion of the available balance every year for five years, resulting in about $100 million invested in housing. But the state determined that by moving these funds from the UPTF into the state’s budget, they would count towards the spending limit imposed by TABOR. With the booming economy already requiring refunds in fiscal year 2016-17 and beyond, using these unclaimed funds would have increased the size of refunds, which would have been paid by reducing spending on other important services.

But an opportunity arose to use those surplus funds in this fiscal year. Despite having TABOR refunds in fiscal years 2014-15, 2016-17 and beyond, the state’s economists forecasted that revenues in fiscal year 2015-16 would be between $80 and $112 million below the TABOR spending limit. CCLP began to recraft our bill to make one large transfer of surplus funds this year. But the Joint Budget Committee, facing the same problem regarding future transfers for dental care, beat us to it: transferring $42 million from the UPTF in 2016 to spend in future fiscal years.

The effect of this action was to reduce the surplus in the UPTF to $43 million and reduce the gap between appropriated funds and the TABOR spending limit available for affordable housing to less than $40 million. Allowing a reasonable margin of error for unexpectedly strong revenue in the second half of the fiscal year, House Bill 1466 will only make a one-time allocation of $30 million to affordable housing. Ironically, TABOR will not allow transfers in the future unless our economy sours and revenues decrease.

Though $40 million would make a difference to thousands of Coloradans seeking affordable housing, there’s clearly something wrong with this picture overall. The UPTF is an available source of funding for this important community need. Without impinging on the UPTF reserve or requiring reductions in spending on other essential publicly funded services, we could be dedicating as much as $100 million to affordable housing over a five-year period. Yet, TABOR requires us to let that money sit unused at a time when the need is greatest.

That’s a shame.

– Claire Levy