View File

Prepared for the Economic Opportunity Poverty Reduction Task Force.

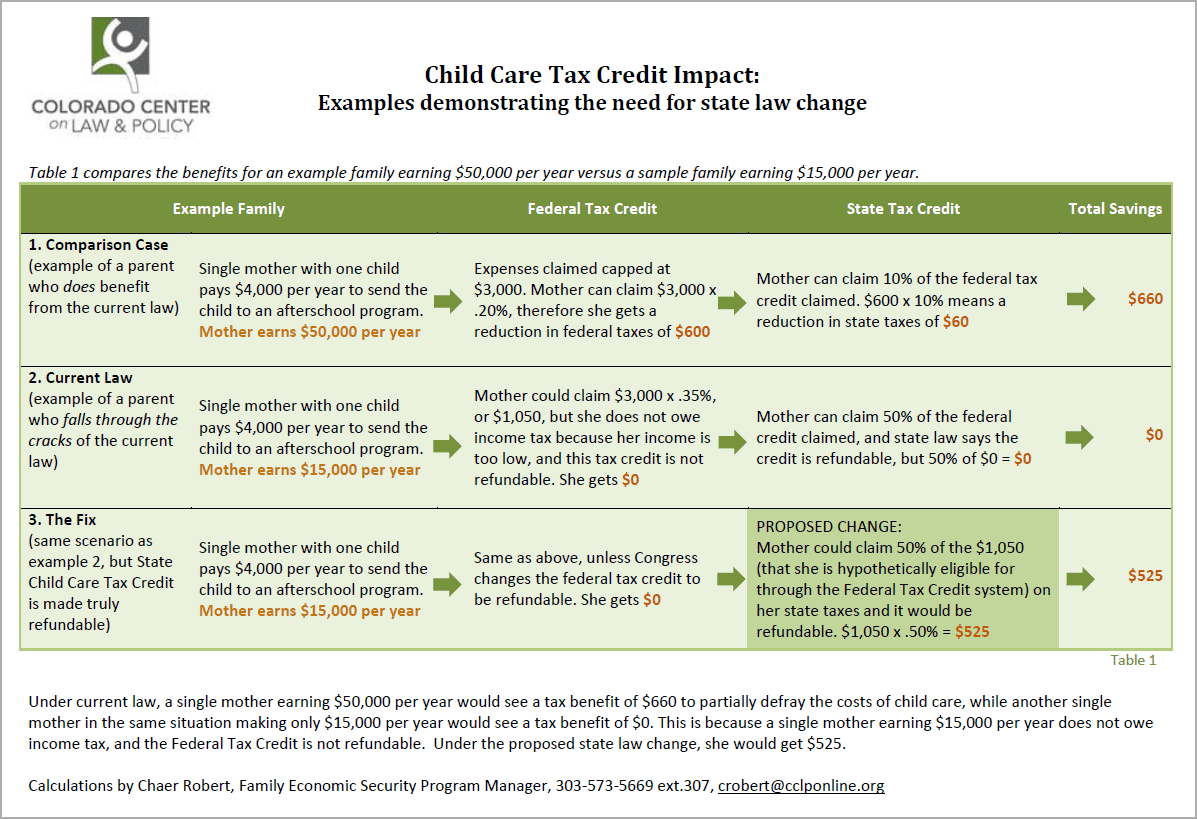

Fixing the child care tax credit would allow the poorest Colorado families to benefit from a tax policy that helps offset the high cost of child care for thousands of other Colorado families.

Colorado already has a child care income tax credit. The amount of the credit is based, in part, on the expenses paid by the family for child care while a parent works or looks for work. The problem rests in the relationship between state and federal tax laws. The state credit is dependent on the federal tax credit.

For Coloradans to be able to claim the Colorado credit on their state taxes, they must also claim the federal child care tax credit on their federal income tax returns. However, the federal credit is available only to families with a certain amount of tax liability, so the poorest people who work, and have kids in child care, are not able to benefit from the federal credit or the state credit.

CCLP Public Comment to HHS Reinterpretation of Federal Public Benefit

Public Comment, Publications