A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

CCLP Opposes Proposition 121: State Income Tax Rate Reduction Grows Inequities

CCLP STRONGLY OPPOSES Proposition 121, which would permanently reduce the state income tax rate for individuals and corporations from 4.55% to 4.40%. This decrease would reduce state revenues by almost $400 million per year. If state revenues fall too far below the constitutional TABOR revenue cap, as they did after 9/11, during the 2008 Great Recession, or in the 2020 COVID pandemic, tax revenue could not be restored until and unless approved by voters, triggering catastrophic program cuts.

Ever since the reduction in the State Income Tax rate from 5% to 4.75% in 1999, certain groups have claimed that “across-the-board income tax rate cuts benefit everyone.” This could not be further from the truth. While rate reductions are more broad-based than many targeted special interest tax breaks, those with income too low to owe income taxes see no benefit whatsoever. The federal standard deduction for a couple is $25,900; a couple earning below that amount per year would receive no tax reduction, since they have no tax liability. Likewise, for a single-filer household, those with an income under $19,400 also would not see even a penny of benefit from a reduction in the state income tax rate.

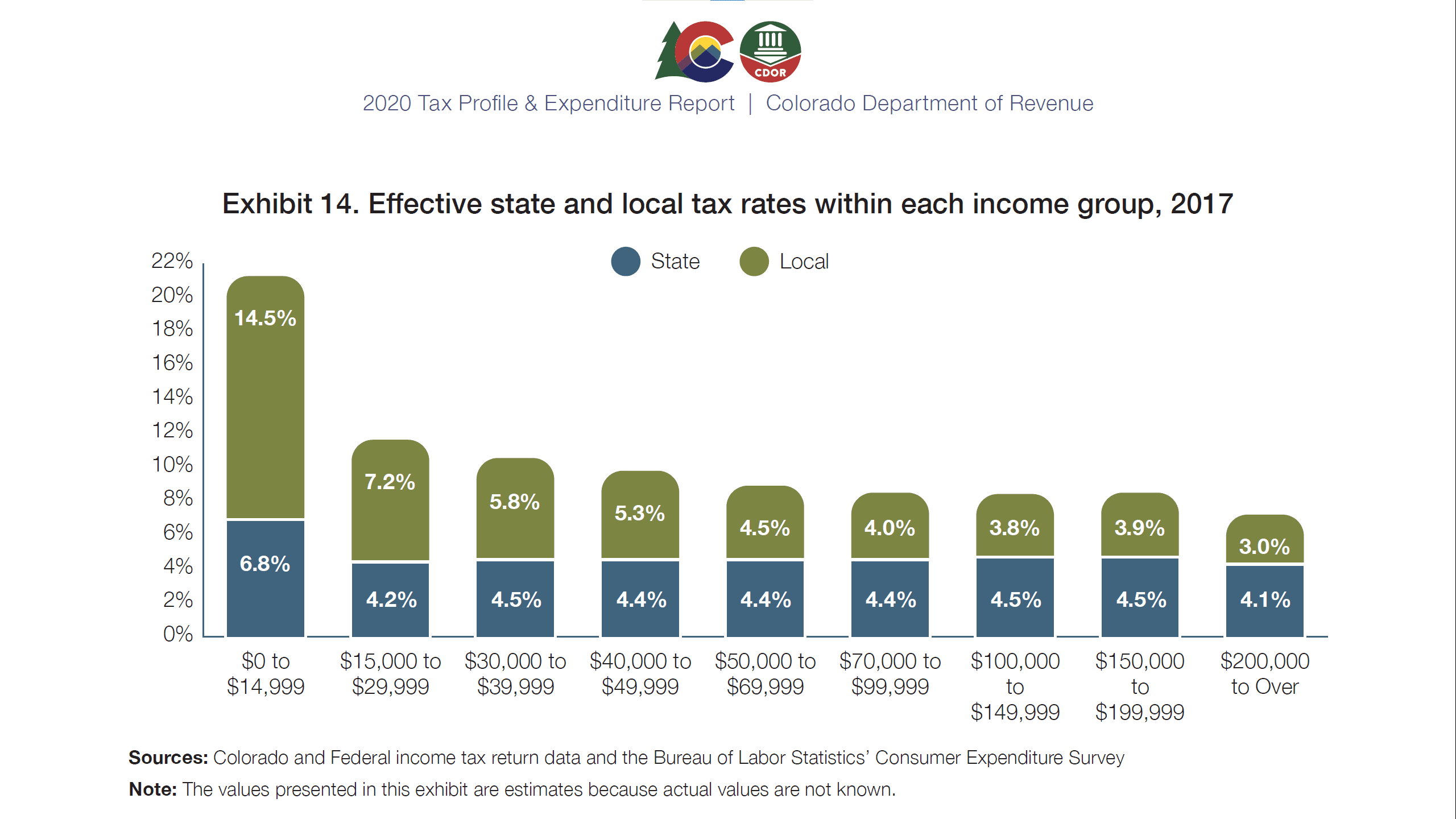

Our TABOR rebates are distributed through our income taxes for ease of administration, but they are state SALES tax refunds. According to the 2020 Department of Revenue Tax Profile and Expenditure Report, the lowest-income Coloradans pay a larger percentage of their income in state taxes (at 6.8%) than wealthy Coloradans (at 4.1%), primarily because of our higher sales tax and flat income tax. Low-income Coloradans pay sales tax, excise tax, and — directly or indirectly through their rent — property tax. Proposition 121, however, limits the tax relief to income taxes only, disregarding the tax burden of sales tax, excise tax, and property tax.

In good economic times, Colorado would be less likely to issue TABOR rebates (or they would be significantly smaller) if this measure passes to reduce income taxes. Struggling Coloradans would likely lose some or all of the TABOR rebate they would otherwise get, since the $400 million in reduced state revenue would reduce or minimize the revenue above the TABOR cap which funds the refunds.

Low-income Coloradans would also be disproportionately affected by cuts to state services like education, health care, and human services if this passes and revenues fall too much.

Does this measure help older Coloradans?

- Since Coloradans over 65 years old get extra income tax breaks already, older adults are less likely to get any additional benefit from the bill’s passage.

- Seniors have a higher standard deduction. For example, if a couple are both over 65, their 2022 standard deduction will be $28,700 instead of $25,900. Income below this level is too low to owe income taxes.

- In Colorado, beginning with the 2022 tax year, Social Security Benefits for adults ages 65 and older are not taxable on one’s state income tax. Coloradans in this age group can also subtract from their income pension and annuity income up to $24,000 if federally taxable social security is below $24,000 per year.

- The median household income for Coloradans ages 65 and up is $54,544. Given the existing income tax breaks older Coloradans get, a majority don’t owe state income states, so a tax rate reduction brings no benefit.

- Only the wealthier minority of seniors would have a state income tax liability which the bill would reduce. And like young tax filers, the wealthiest of older adults would receive the greatest benefit.

This measure grants financial relief to those who need it the least. It makes permanent cuts, citing this years’ economics, neglecting to plan for needs and unexpected challenges in the years to come. It ignores the disproportionate tax burden low-income Coloradans bear, focusing solely on income tax. This measure would grow inequities in Colorado’s tax policy, while putting at grave risk the funding for necessary programs across the state. CCLP opposes Colorado Proposition 121 and urges all Coloradans to vote NO.