A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

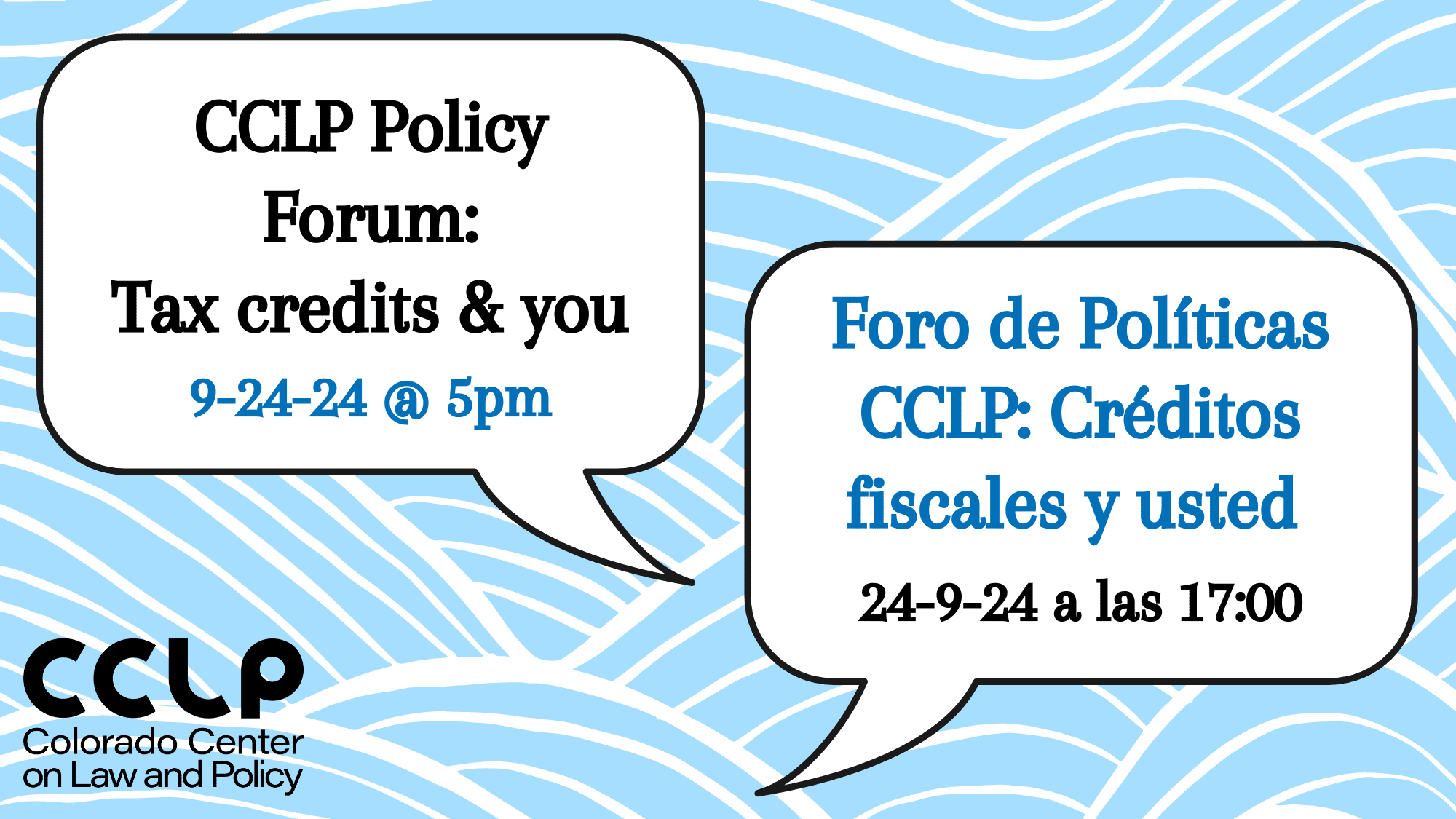

CCLP Policy Forum: Tax credits & you recap

Intro

CCLP hosted our fourth iteration of our Policy Forum series which focused on tax credits, both at the federal and state level. While many might associate tax credits with big corporate loopholes and giveaways to the rich, we centered our presentation and discussion around tax credits that empower people in our communities to benefit directly.

Income is one of CCLP’s four focus areas, and tilting our tax code to benefit those facing income insecurity has been a focus of our advocacy and policy agenda for some time now. CCLP has partnered with other organizations and advocates throughout the legislative session and beyond to bring progressive tax policies to Colorado’s tax system.

Tax credit presentation

Charles Brennan, CCLP’s Income and Housing Director, shared a short presentation on tax credits in Colorado, providing definitions, examples, and the benefits and barriers to tax credits. According to Brennan’s simplified explanation, tax credits are available to you when you file your taxes—state and/or federal—and they work by reducing the income tax you would owe to the government.

In Colorado, taxpayers have the opportunity to receive multiple tax credits if you file your federal and state taxes. At the federal level, taxpayers might be eligible for the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), or the Child and Dependent Care Tax Credit (CDCTC). At the state level, taxpayers might be eligible for the Colorado EITC and CTC, and starting in 2025, the Family Affordability Tax Credit. Brennan also noted that Colorado’s tax credits are available to people without a work eligible Social Security number, so long as they have an individual tax identification number (ITIN).

While these tax credits are beneficial to many, there are some barriers and challenges to them. Many Coloradans who are eligible for these tax credits do not claim them each year. Additionally, federal tax credits are only available to those with a Social Security number. These tax credits are also designed to support families with children and often do not provide as much support to single adults without kids.

Panel discussion

After providing a short presentation on tax credits, Brennan introduced our three panelists involved in our curated discussion: Chaer Robert, Caroline Nutter, and Isabel Dickson. Each were asked a variety of questions relating to tax credits and their interest in the topic.

Currently serving as CCLP’s Emeritus Advisor, Robert first got involved with state tax credits in 1999, inspired by the power of cash for individuals because, as she put it, this form of public benefit “helps [Coloradans] set their own priorities.”

Caroline Nutter is the Legislative Coordinator for the Colorado Fiscal Institute (CFI). According to Nutter, CFI “cares about the EITC and CTC because they know how effective tax credits really are,” stating “they are one of the best anti-poverty tools we have.”

Isabel Dickson is the Economic Mobility Program Manager at the Colorado Department of Public Health and Environment (CDPHE). Dickson stated the reason CDPHE is interested in people’s economic status is because “poverty is a social determinant of health, meaning it’s a root cause of inequitable, poor health outcomes.”

TABOR & tax credits

We have seen a rise in tax credits in Colorado because we are limited by our Taxpayer Bill of Rights, or TABOR. TABOR is one of our constitutional restraints when it comes to tax policies, as it limits the amount of revenue the state of Colorado can retain and spend.[1] This means Colorado is often struggling to fund public programs, education, parks, and more.

When asked about the future of tax credits in Colorado, Nutter offered two solutions: fiscal reform and revenue generation. Because we are planning for a tighter state budget in the fiscal years to come, we are not going to see many TABOR surpluses like in the last few years. TABOR will continue to suck funds out of the state unless we reform the way we structure our tax code.

Raising any revenue for policies is difficult in Colorado, so one way to achieve our policy goals is to fund it through a tax credit. There is data to prove that tax credits are spent on school-related expenses, food, and childcare.[2] But as Brennan provided in his presentation, there are limitations to accessing tax credits such as language barriers, the fear of owing money to the government, and/or lack of awareness by individuals who may be eligible for tax credits.

Tax filing

The panel discussed the new tax filing resources found at Get Ahead Colorado. This bilingual public information campaign from the CDPHE connects people with accurate information on where and how to file their taxes. The website is available in English and Spanish (El sitio web está disponible en inglés y español.)

As discussed at the event, in 2026, filers will be able to directly file their state and federal taxes with Direct File, a free tax tool by the IRS, which will eliminate any expenses related to filing your taxes.[3] “Tax codes change from year to year,” Dickson stated, “but the message is simple and doesn’t change: file. We can all play a part in getting the word out to our families and communities.”

Community forum & Conclusion

The third and final section of the forum let community members ask our panelists questions and/or share their personal experiences with tax credits. Some of the topics covered included adjusted gross income, the Colorado child care contribution tax credit, incentivizing work through tax credits, tax preparation as a lucrative business, and more.

As the event wrapped up, Brennan reminded attendees that tax credits are an essential part of Colorado’s tax system, as they provide economic benefits for working and low income families. Many families rely on tax credits to increase their economic mobility and support their household. Because of the constraints TABOR has on our tax code, tax credits continue to be a critical piece of progressive tax policies in Colorado.

Thank you to all who attended our event. We look forward to hosting more policy forums in the future!

Watch the recording here.

Mira la grabación aquí.

**********

[1] https://leg.colorado.gov/agencies/legislative-council-staff/tabor

[2] https://www.commonsenseinstituteus.org/colorado/research/taxes-and-fees/colorados-expanded-tax-credits-targeting-lower-income-families

[3] https://tax.colorado.gov/press-release/saving-time-and-money-direct-file-for-federal-and-state-tax-returns-available-in-2026