A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

CCLP’s 2024 legislative wrap-up, part 1

On May 8, 2024, the second regular session of the 74th Colorado General Assembly came to a close. This year, Colorado saw a whopping 705 bills introduced—472 in the House and 233 in the Senate—making it one of the highest totals of bills in recent sessions.

As is often true in election years, legislators sought bragging rights on legislative wins to address their constituents’ priorities. Legislator positions often took a partisan tone, but several bipartisan compromises still ultimately succeeded, notably on the subject of tax rates and credits. Additionally, an unexpectedly tight budget this session led to a rush to reduce the fiscal impact of proposed legislation, and to some creative efforts to utilize the TABOR surplus.

In short, this year brought a lot of new challenges and a rapidly shifting landscape for policy advocacy, causing CCLP and other organizations to pivot and problem-solve from January to May. Nevertheless, we have much to be grateful for, and many shared accomplishments to celebrate.

CCLP data

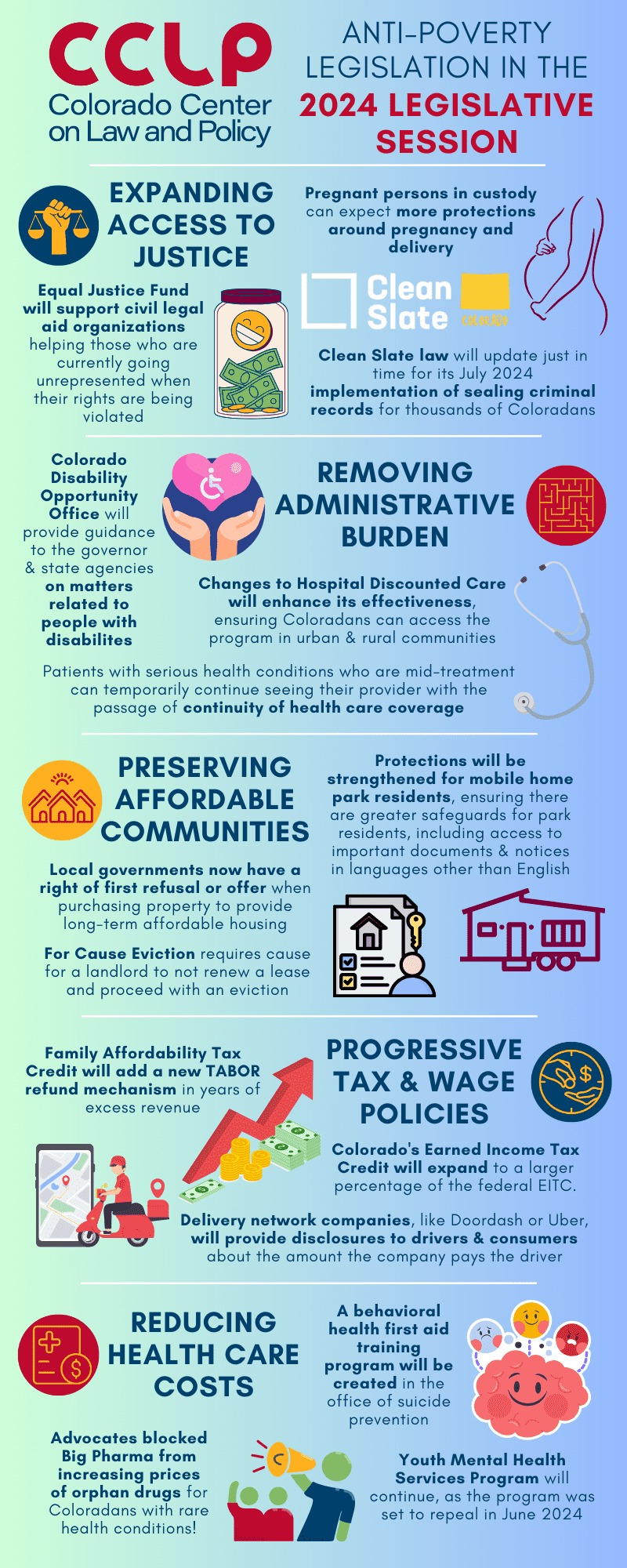

This year, CCLP changed up the way we framed the legislative session. Instead of arranging our priorities to match our focus areas in food, health, housing, and income, we identified five specific policy areas where opportunities existed to make real change, in partnership with other advocacy groups, community members, legislators, and state leaders. The five policy areas included expanding access to justice, removing administrative burden, supporting progressive tax and wage policies, preserving affordable communities, and reducing health care costs.

CCLP took positions on 67 bills — supporting 59, monitoring five, and opposing three — the most we’ve ever engaged in. Of the 59 bills we supported, 11 were postponed indefinitely, two lost, and one was vetoed by the Governor, leaving us with a 76 percent success rate. Many of the lost bills, not surprisingly, were casualties of the budgetary constraints. Of the three bills CCLP opposed, all three lost, avoiding changes to state law which would have harmed Coloradans living in poverty.

This year, we focused on six priority bills, including House Bills 1133, Updates to Colorado Clean Slate Act; 1286, Equal Justice Fund; 1294, Updates to Mobile Home Park Act; and Senate Bills 060, Prescription Drug Affordability Board (PDAB) Exempt Orphan Drugs; 116, Updates to Hospital Discounted Care; and 211, Adjustments to the Necessary Document Program.[1]

CCLP staff provided written and live testimony on 18 bills. (You can read most of CCLP’s testimonies right here on our website!) Our work was also referenced, featured, or quoted in 15 news articles throughout the session, by CPR, The Denver Post, The Colorado Sun, Public News Service, and more. Most importantly, CCLP engaged with community members to testify on several of our bills. In a first for Colorado’s legislative process, some of those community members provided their testimony through simultaneous interpretation at the Capitol. This change alone marks a much needed improvement in our state’s democracy, ensuring more voices are heard at critical junctures of lawmaking.

Expanding access to justice

This year, CCLP advocated to ensure Coloradans can assert their rights, whether that means improving access to courts or increasing accountability by private and public entities. Two of our priority bills fall in this category, HB24-1133, Updates to Colorado Clean Slate Act and HB24-1286, Equal Justice Fund. Both of these bills passed.

Currently, Colorado ranks 31st in the nation per capita state legal aid funding, meaning only one legal aid lawyer is available for every 13,000 eligible low-income residents. With few attorneys available to serve lower-income households, violations of laws affecting housing, public benefits, and civil rights go unenforced and people have no recourse for the harm they experience. With the passage of the Equal Justice Fund, Colorado will now support civil legal aid organizations helping those who are currently unrepresented when their rights are violated.

During the 2022 legislative session and with near unanimous support, CCLP and partners helped pass the Colorado Clean Slate Act, a bill that automates sealing of records. The coalition brought forward HB24-1133 in the 2024 session to facilitate implementation of that bill and clarify aspects of the petition-based process. Those bills will improve outcomes for Coloradans who deserve a second chance.[2]

HB24-1368, Language Access Advisory Board was signed into law by the Governor on May 28, 2024. This law will create a 13-member board with the purpose of assessing and developing recommendations for improving access to the legislative process for populations with limited English proficiency. This proposal must get input from both public comments and subject matter experts. As previously mentioned, this year we have already started to see the benefits of expanding language access at the Capitol. CCLP is confident in the positive impacts of continuing to expand Coloradans’ access to justice.

Removing administrative burden

CCLP aimed to reduce unnecessary hurdles that are so often a barrier for people who face poverty so that Coloradans can meet their basic needs and become self-sufficient. Two of our priority bills dealt with removing administrative burdens: SB24-116, Updates to Hospital Discounted Care and SB24-211, Adjustments to the Necessary Document Program. Good news? SB24-116 was signed into law by the Governor on May 31, 2024. Bad news? SB24-211 lost in committee after many months of collaboration and stakeholdering.

In 2021, CCLP was a part of the wide-ranging coalition that worked to pass HB21-1198, Health-care Billing Requirements For Indigent Patients, better known as Hospital Discounted Care. Hospital Discounted Care was implemented in September 2022, and since then patients and health care facilities have found opportunities to improve the program’s functioning.[3] This year’s bill gives hospitals the ability to quickly enroll eligible patients into Medicaid through the presumptive eligibility process and exempted rural clinics from requirements, as long as they have a sliding-scale fee structure that is approved by the Department of Health Care Policy & Financing (HCPF).

Although Colorado’s Necessary Document Program was made permanent in 2021, limited funding and other complications make it challenging for residents to get free identification documents through the voucher program. Problems include reliance on paper vouchers with short expiration dates, and less-than-ideal successful redemption rates. SB24-211 this year would have eliminated the need for a physical voucher, allowing eligible individuals to access ID documents directly at the point of service.[4] Unfortunately, more work is needed to align stakeholder goals and the bill was postponed indefinitely in its first committee.

Individuals with disabilities gained more representation with the passage of HB24-1360, Colorado Disability Opportunity Office. The Office will provide guidance to the governor and state agencies on matters related to people with disabilities. Its intention is to implement a statewide strategy to facilitate full societal integration by investing in the success of individuals with disabilities. This bill reminds us to view anti-poverty legislation through an accessibility lens, where barriers consistently prevail in the disability community.[5] Additionally, Patients with serious health conditions who are mid-treatment can temporarily continue seeing their provider, even if they’ve had a change in coverage, with the passage of SB24-093, Continuity of Health-Care Coverage Change. Colorado now joins states like Montana, Arizona, and Iowa that protect enrollees when they change plans altogether by allowing them to continue for up to 90 days with their provider.[6]

HB24-1400, Medicaid Eligibility Procedures, allows the state to continue using federally-approved flexibilities in the eligibility renewal processes when necessary to ensure that people retain coverage. Beginning in 2023, the federal Center for Medicare and Medicaid Services (CMS) had allowed states to request authority to use Section 1902(e)(14)(A) waivers, and in May 2024, CMS announced that these unwind-related waivers could be extended an additional six months, through June 30, 2025.[7] HB24-1400 will extend authority in Colorado through January 1, 2025, which fails to take advantage of the full period offered currently by CMS – a period which might even be extended again. CCLP has been following the PHE unwind, identifying processing errors and delays, tracking the high rate of Medicaid terminations, and providing resources to those seeking a Medicaid appeal. We encouraged the state Medicaid agency, HCPF, to take advantage of the full opportunity provided by CMS guidance and HB24-1400 to explore more ways to keep eligible Coloradans enrolled.

Progressive tax and wage policies

CCLP continued to back progressive tax and wage policies that boost the incomes of working families and bring more stability to household budgets. Due to budget constraints, many coalitions and legislators had to come up with different ways to obtain funding, many of which came in the form of a tax credit, which taps dollars above the TABOR cap.

HB24-1311, Family Affordability Tax Credit, will add a new TABOR refund mechanism in years of excess revenue. Another tax credit HB24-1134, Adjustments to Tax Expenditures to Reduce Burden, expands the state EITC to a larger percentage of the federal EITC in 2024 and all future years. The percentages for 2025 and later years depend on projects of state revenue in the December forecast each year. And with the passage of HB24-1288, Earned Income Tax Credit Data Sharing, data sharing between state agencies is allowed. It requires the creation of a pilot program to assist a number of resident households in filing or amending a tax return and claiming the federal and state EITC or Child Tax Credit for up to 2 prior tax years. This would put more money in the pockets of those who need it most. The IRS created a similar program, Direct File pilot, for residents in 12 states to file their taxes. The pilot was a success with over 140,000 taxpayers filing their taxes. The program was accessible, easy to use, and proved that taxpayers want more than one no-cost option for filing electronically.[8]

CCLP supported wage policies such as:

- HB24-1129, Protections for Delivery Network Company (DNC) Drivers, which will require DNCs, like Doordash or UberEats, to provide various disclosures to its drivers and consumers regarding payments that consumers make to the company and the amounts the company then pays to drivers.

- HB24-1095, Increasing Protections for Minor Workers, which will increase penalties for violations of the “Colorado Youth Employment Opportunity Act of 1971” and require that the penalties be deposited into a wage theft enforcement fund. Entities that violate the act must also pay specified damages to the aggrieved individual. Both of these bills provide more transparency and protections around workers’ wages.

Unfortunately, the Governor also decided to veto three workers’ rights bills, including HB24-1008, Wage Claims Construction Industry Contractors, which would have expanded general contractor accountability for wage claims involving contractors in the construction industry. Governor Polis sided with businesses over employees, despite his claims to fighting “for hardworking Coloradans.”[9]

Click here to read CCLP’s 2024 legislative wrap-up, part 2

**********

[1]Some of these are not the actual names of the bills, and instead what the bill has previously been known as.

[2] https://drive.google.com/file/d/1v8I7sbBUeg3Wv0za57N16ke34a0d37BI/view

[3] https://copolicy.org/wp-content/uploads/2024/03/SB24-116-2-Pager-FINAL.pdf

[4] https://copolicy.org/wp-content/uploads/2024/02/ID-Documents-Fact-Sheet.pdf

[5] https://coloradonewsline.com/2024/04/08/disability-opportunity-office-colorado/

[6] https://copolicy.org/news/cclp-testifies-in-support-of-continuity-health-care-coverage/

[7] https://www.medicaid.gov/federal-policy-guidance/downloads/cib050924-e14.pdf

[8] https://www.irs.gov/newsroom/irs-makes-direct-file-a-permanent-option-to-file-federal-tax-returns-expanded-access-for-more-taxpayers-planned-for-the-2025-filing-season

[9] https://www.coloradopolitics.com/news/protesting-polis-vetoed-wage-theft/article_79a72f7c-194c-11ef-b4df-23aa9722d1ae.html#:~:text=Polis%20stood%20with%20the%20business,to%20fighting%20for%20hardworking%20Coloradans.