Charles Brennan provided testimony in support of House Bill 24-1129, Protections for Delivery Network Company Drivers. CCLP is in support of HB24-1129.

Recent articles

CCLP testifies in support of TANF grant rule change

CCLP's Emeritus Advisor, Chaer Robert, provided written testimony in support of the CDHS rule on the COLA increase for TANF recipients. If the rule is adopted, the cost of living increase would go into effect on July 1, 2024.

CCLP testifies in support of updating protections for mobile home park residents

Charles Brennan provided testimony in support of House Bill 24-1294, Mobile Homes in Mobile Home Parks. CCLP is in support of HB24-1294.

CCLP’s legislative watch for April 5, 2024

For the 2024 legislative session, CCLP is keeping its eye on bills focused on expanding access to justice, removing administrative burden, preserving affordable communities, advocating for progressive tax and wage policies, and reducing health care costs.

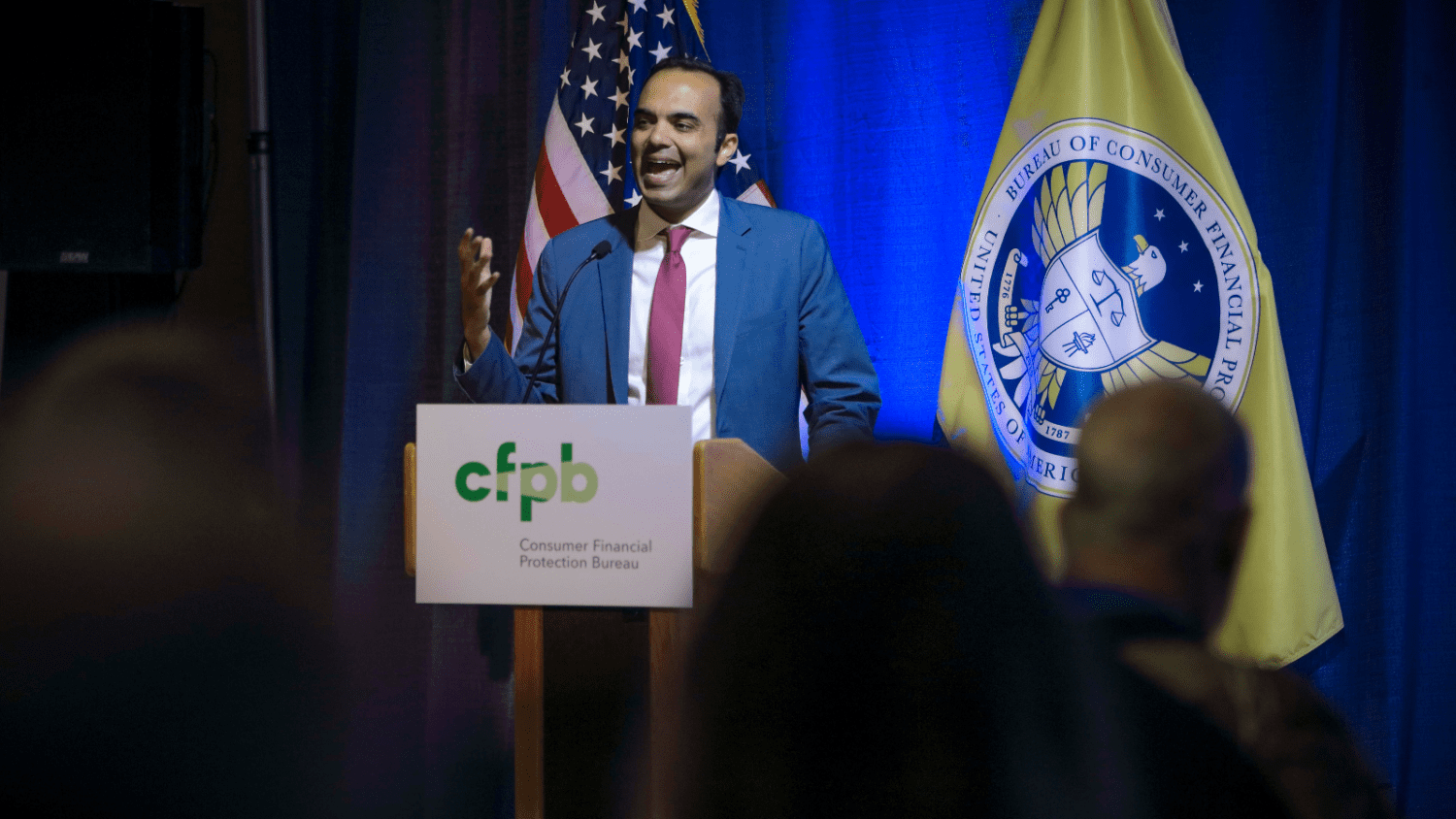

PRESS RELEASE: Consumer Financial Protection Bureau announces groundbreaking plan to protect Americans from the devastating effects of medical debt

The following announcement was jointly released by our partners at National Consumer Law Center, Community Catalyst, the National Association of Consumer Advocates, RIP Medical Debt, and U.S. PIRG.

WASHINGTON – Consumer advocates at the National Consumer Law Center (NCLC), Community Catalyst, Americans for Financial Reform, National Association of Consumer Advocates, RIP Medical Debt, U.S. PIRG, and Colorado Center on Law and Policy cheer today’s announcement that the Consumer Financial Protection Bureau (CFPB) is proposing a prohibition on the reporting of all medical debts on credit reports.

“Negative credit reporting is one of the biggest pain points for patients with medical debt,” said Chi Chi Wu, senior attorney at the National Consumer Law Center. “When we hear from consumers about medical debt, they often talk about the devastating consequences that bad credit from medical debts has had on their financial lives. A bad credit score doesn’t just affect your ability to get credit, but also your employment prospects, insurance rates, and ability to get rental housing. Yet, as the CFPB has found, medical debt has limited predictive value for creditworthiness compared to other types of debts.”

NCLC filed a petition to the CFPB in September 2022 requesting that the CFPB start a rulemaking process to ban the reporting of medical debts on credit reports. Community Catalyst also filed a petition to ban the reporting of medical debts in April 2023, for which U.S. PIRG filed a comment in support.

“We applaud the Biden-Harris administration for taking important steps to address the medical debt crisis in America,” said Emily Stewart, executive director, Community Catalyst. “This is an important milestone in our collective efforts and will provide immediate relief to people that have unfairly had their credit impacted simply because they got sick. Nobody, no matter where we live or how much money we have, should be forced to make the impossible choice between getting essential care and going into debt.”

Voluntary credit reporting changes by Equifax, Experian, and TransUnion instituted a one-year delay before including alleged medical debts on credit reports. The three credit bureaus also eliminated the reporting of unpaid medical debts less than $500 and removed paid medical debts. However, CFPB research highlighted the limitations of these changes, including that about half of consumers with medical debts on their credit reports would continue to have those debts reported after the voluntary changes and that consumers whose debt would be removed were more likely to be white and higher income.

“The voluntary changes by the credit bureaus were simply not enough,” said Julia Char Gilbert, Connelly Policy Advocate at Colorado Center on Law and Policy. “Patients with medical debts over $500 are often most vulnerable to the catastrophic harms of damaged credit reports, a key reason that Colorado moved to ban credit reporting of all medical debt. The CFPB’s decision to extend these protections to all Americans is a huge win for patients and their families.”

“Once again, the CFPB delivers for millions of consumers,” said Elyse Hicks, consumer policy counsel at Americans for Financial Reform “This is why it’s so important to defend the CFPB and ensure its continued survival in the face of attacks by corporate America.”

“With this thoughtful action, the Bureau will relieve patients of the burden that unpredictable and often confusing medical bills could negatively impact other aspects of their financial lives,” said Christine Hines, legislative director at the National Association of Consumer Advocates. “Removing credit reporting of shock medical debts will no doubt improve the financial well-being of millions of people.”

“As the leader of an organization committed to erasing burdensome medical debts, I’m thrilled to see this action taken by the CFPB,” said RIP Medical Debt CEO and president Allison Sesso. “This proposal ensures no one’s credit worthiness hinges on their necessary healthcare. And while this is a great stride, we need the federal government to also identify, absent credit reporting data, how we can continue to track the scale of this enormous crisis. Medical debts are often obscured from reporting when patients pay with credit cards or borrow money from friends/family.”

“As health care prices rise and patients are left shouldering more of the costs in out-of-pocket expenses, this announcement is welcome news,” said Patricia Kelmar, senior director of health care campaigns for U.S. PIRG. “We’ve known for years that medical debt doesn’t predict credit defaults, nor does it accurately predict a person’s desire and willingness to pay off loans. In fact, CFPB’s own research showed that medical billing data on a credit report is ‘less predictive of future repayment than reporting on traditional credit obligations.’”

“This will help millions of consumers whose credit reports contain medical debts, including Black consumers who are disproportionately burdened by medical bills,” said Berneta Haynes, senior attorney at the National Consumer Law Center. “The CFPB’s research found that 13.5 percent of consumers with credit reports – about 27 million Americans – have medical debts shown on their credit reports.” Ms. Haynes is the author of a March 2022 NCLC report The Racial Health and Wealth Gap: Impact of Medical Debt on Black Families.

Since 1969, the nonprofit National Consumer Law Center® (NCLC®) has worked for consumer justice and economic security for low-income and other disadvantaged people in the U.S. through its expertise in policy analysis and advocacy, publications, litigation, expert witness services, and training.

Community Catalyst is a national organization dedicated to building the power of people to create a health system rooted in race equity and health justice, and a society where health is a right for all. We’re an experienced, trusted partner to organizations across the country, a change agent to policymakers at the local, state, and national level, and both an adversary and a collaborator to health systems in our efforts to advance health justice. We partner with local, state and national organizations and leaders to leverage and build power so that people are at the center of important decisions about health and health care, whether they are made by health care executives, in state houses, or on Capitol Hill. Together with partners, we’re building a powerful, united movement with a shared vision of and strategy for a health system accountable to all people.

Colorado Center on Law and Policy is a non-partisan, nonprofit advocacy organization dedicated to the vision that every Coloradan should have what they need to succeed. For 25 years CCLP has stood with diverse communities across Colorado in the fight against poverty through research, legislation and legal advocacy.

The National Association of Consumer Advocates (NACA) is a nationwide non-profit membership organization of private, public sector, legal services and non-profit attorneys, law professors, and law students whose primary interest is the protection and representation of consumers. Since its inception, NACA has focused on issues concerning unfair, deceptive, abusive and fraudulent practices by businesses that provide financial and credit-related services.

RIP Medical Debt is a national 501(c)(3) nonprofit that has acquired — and abolished — more than $10 billion of burdensome medical debt, helping 7 million families and addressing a major social determinant of health. RIP partners with individuals, faith-based organizations, foundations, corporations and government to empower donors by converting every dollar contributed into $100 of medical debt relief on average.

U.S. PIRG is an advocate for the public interest with PIRG affiliates in two dozen states. We promote policies that protect consumers and support the delivery of the high value healthcare we deserve.