A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

Got health coverage? Connect with the exchange

Being part of a community, whether it’s Colorado as a whole, your farming community, Glenwood Springs or Denver’s Westwood neighborhood means that you give and you get. You give your labor, your taxes, your neighborly advice, your willingness to turn the music down, and you get in return the many benefits a thriving community can offer.

Despite that, many of us may not be getting the health care we want and need. During an Oct. 19 presentation by Colorado’s Division of Insurance and individual carriers, consumers spoke with dismay about huge hikes in premium costs for 2018, and about deductibles that make it hard to access care. Six percent or more of those hikes can be attributed to the White House decision to cut off funding to carriers for consumers’ cost-sharing reductions (CSR), as reported recently by CCLP, but the remaining 30 percent stems from high medical costs and continuing federal uncertainty about federal support for the Affordable Care Act’s principles and systems.

Despite the political turmoil, many households can afford coverage if they take advantage of what Connect for Health Colorado offers between Nov. 1 and Jan. 12 during the state’s open enrollment period.

Over half of Colorado residents who lack access to employer-based coverage can get credits that make coverage affordable. Despite skyrocketing premiums, households that receive premium assistance will end up with lower premiums in 2018 than in 2017 on average, because tax credits will rise too, according to the recent Wakely report. The figures have shifted since the news on CSR, but the result remains: most eligible enrollees can have lower premiums in 2018 than in 2017.

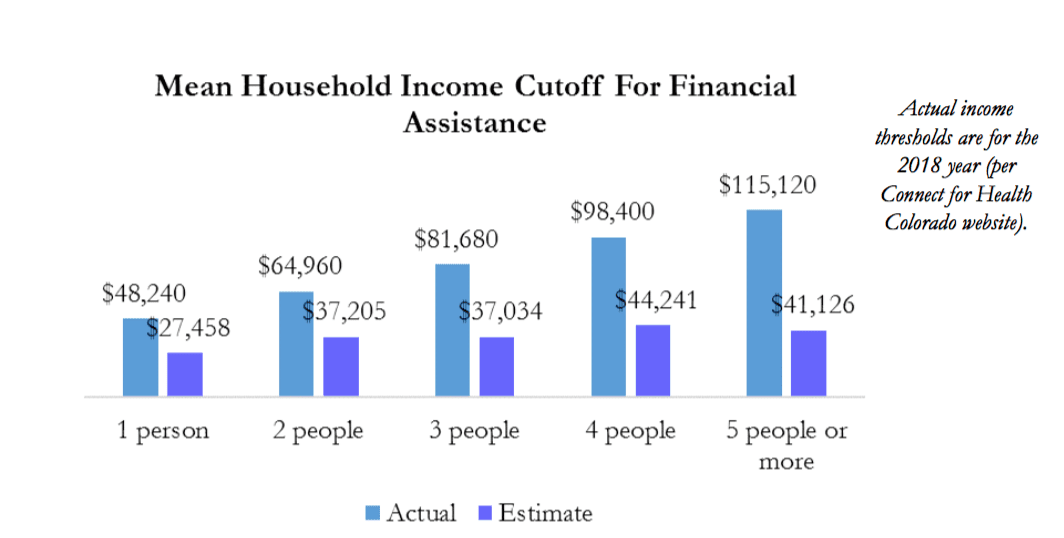

Coloradans can qualify for credits at much higher income levels than they realize. Households surveyed by Connect for Health were way off when asked to estimate how much they could make and still qualify for help with premiums. On average, respondents said individuals would have to make under $28,000, though $48,240 is the actual maximum. How about a family of four? Households with income up to $98,400 can qualify, but respondents thought families could make only half as much.

Deductibles, cost-sharing, and out-of-pocket maximums can be sharply reduced for individuals and households with lower incomes. Despite the White House decision to cut off CSR funds to carriers, the program is still fully available to those who purchase a silver plan through the exchange and have income under 250 percent of the federal poverty level (FPL). Individuals who earn less than $30,150 can benefit, with a $2500 silver plan deductible shrinking to just $25 for someone making $18,000 or less, like the dishwasher who works 35 hours a week, year-round, at minimum wage.

Tens of thousands of Coloradans could get coverage for less. So why have so many eligible Coloradans failed to get tax credits in the past? Some don’t know that they might qualify. For others, the lengthy and historically buggy application process is an issue, and they prefer to purchase coverage without getting screened for eligibility. With a potential annual benefit worth more than the used car you have your eye on, it’s worth it to get screened. On top of that, the IRS will be rejecting tax returns unless taxpayers indicate whether they had coverage, were exempt from the requirement, or made the individual shared responsibility payment.

For those who can’t qualify, coverage will cost a whole lot more. One primary reason is that high health care costs drive up premium prices. The reasons range from lack of cost transparency to out-of-network billing, and from soaring drug prices to lack of carrier competition in western counties. Fixes for those problems will require bipartisan action from our state legislators. That action could yield results that benefit all Coloradans, from those who access coverage through employers and public programs, to the many who need affordable and usable individual coverage.

-By Bethany Pray