A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

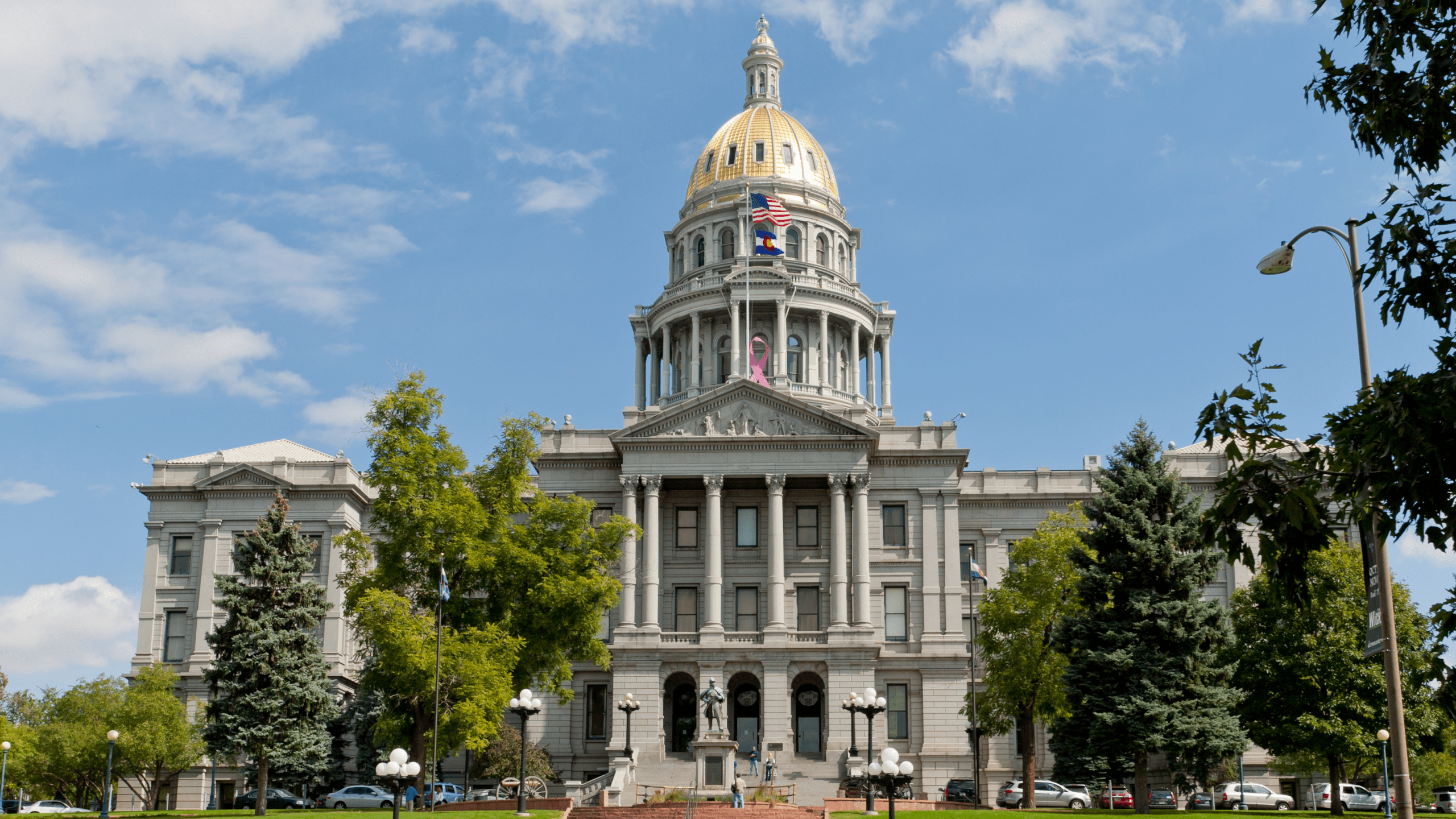

2023 Legislative Review, Part 1: Housing and Income

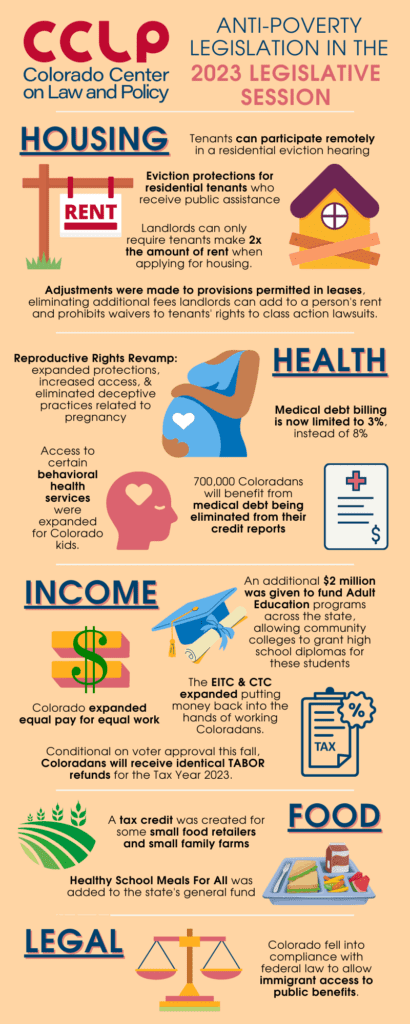

With more than 600 bills introduced, several late-night testimonies and deliberations, and new legislators getting their first experience at the lay-of-the-land, the 2023 legislative session was momentous for the anti-poverty movement. This year, Colorado Center on Law and Policy advocated in support of 53 bills, 44 of which passed, including four of our top legislative priorities. More than half of CCLP’s staff provided written or live testimony for 18 bills, which is a considerable feat as this year was many of our staff’s first session, let alone their first time testifying. And after 25 years, CCLP continues to work towards a thriving Colorado where everyone has what they need to succeed.

Tax credits and rebates

Currently, around 300,000 Coloradans receive the Earned Income Tax Credit (EITC) and approximately 150,000 families receive the Child Tax Credit (CTC). The passage of HB23-1112, Earned Income and Child Tax Credits, raises the EITC from 24% of the federal EITC to 38%, increasing the help to struggling families, but only for the Tax Year 2024. With amendments to the bill, CCLP was most excited to make a permanent change to our CTC by creating flat-rate income tiers. Beginning in TY2024, families with income(s) below $25,000 receive a flat-rate of $1,200 per child. Currently, families earning less than $12,500 per year receive a smaller CTC amount or none at all.

CCLP has long opposed the 6-tier sales tax rebate structure of TABOR refunds, which gives the largest refund to the wealthiest tax filers and the smallest amount to low-income individuals. Unfortunately, the voter-approved reduction in the state income tax rate last fall[i] was not a net benefit for Coloradans with lower income(s). It reduces any TABOR refund they might receive and provides little or no benefit due to their income(s) being too low to owe much in income tax.

The flat TABOR refund authorized for the Tax Year 2021, with the passage of SB22-233, gave every tax filer an equal amount of $750, or $1,500 if filed jointly, but was only applicable for that year. This year, HB23-1311, Identical Temporary TABOR Refund, also determined for one year only, TY2023, was introduced in the last three days of session. The refund is conditional on voters approving proposition HH at the November 7, 2023, statewide election, and would be paid out when people file their taxes in early 2024. SB23-303 was also introduced days before the 2023 session ended and is similarly conditional on voters approving proposition HH. This ballot measure would provide property tax relief for homeowners and businesses from the money above the TABOR cap and would also provide school funding and some assistance to certain renters.

Education, training, and employment

A key to increasing one’s income is advancing one’s education. Nearly 300,000 Colorado adults lack high school diplomas. Many of these individuals are barred from most jobs and even skills-training opportunities. With Spring Institute, the Skills2Compete Coalition, and a coalition of adult education providers, SB23-007, Adult Education, was developed and passed. It triples ongoing state funding for adult education from less than $1 million per year to $3 million per year. It also reduces and tailors reporting requirements for adult basic education programs who teach students reading below a 9th grade level. The bill explicitly adds digital literacy to the scope of adult education, given the considerable need for all adults to have fundamental digital skills for every aspect of our society. And lastly, it lets community colleges grant a high school diploma to their own adult education students, opening the door for adult Coloradans to prosper in their careers.

In terms of workforce development, the largest and most far-reaching bill this session was the Governor’s HB23-1246, Support In-demand Career Workforce. This bill puts a one-time $39 million into paying for community college classes for those seeking short-term credentials to help fill critical workforce shortages, specifically in education, nursing, early childhood education, law enforcement; and another $1.4 million into construction-related apprenticeship programs. This is a great opportunity for those who would like to enter these fields but were held back by the cost.

CCLP and the Skills2Compete Coalition also lobbied for enhanced funding for SNAP Employment and Training, HB23-1124, which would have renewed HB21-1270, a bill we passed in 2021. Each state or local dollar would have been matched with a federal dollar to continue and expand providing support services and training to those on SNAP seeking employment and taking a new job. Currently, only 28 of Colorado’s 64 counties have the SNAP Employment and Training Program, Employment First. With HB23-1124 being postponed indefinitely by this year’s legislature, Skills2Compete will continue to work with the Colorado Department of Human Services (CDHS) on enhancements and improvement to this program that is the entry door to workforce development for many Coloradans.

Fair Workweek

Beyond education and training for employment, another major factor in many employment sectors is the issue of job quality, a major factor in the workforce shortages many employers and sectors are experiencing. Jobs without predictable schedules, when employers call in workers, or send them home, without advanced notice, or conversely, in which overtime work can be required without advance notice, or jobs without a set number of hours per week can wreak havoc on a person’s life. A shortage of expected hours can leave workers short on rent or at risk of losing SNAP and/or other benefits.

One in four households in Colorado are unable to make ends meet, and countless more depend on stable incomes to help them budget for their family’s needs each month.[ii] Unpredictable hours make it hard to arrange childcare, to enroll in training, difficult to make medical appointments, or even maintain a second job.

CCLP was proud to support HB23-1118, Fair Workweek Employment Standards, led by 9to5 Colorado, State Innovative Exchange, and Towards Justice. Though the bill was killed in the first committee, CCLP’s research on this issue will help with the continuing efforts to address this major issue affecting workers in low paid jobs.

Housing and land use

The high cost of housing affects a large swath of Coloradans. For every 100 Coloradans who earn the Area Median Income, there are only 102 homes available. But for every 100 Coloradans whose income is below 30% of the Area Median Income there are only 26 available homes.[iii] As proponents of affordable housing and tenant rights, CCLP continues to be an active member of the Renters’ Roundtable. We supported 10 tenant protection bills led by partner organizations. Unfortunately, the two bills which received the most contention – HB23-1115, removing a ban on local rent control, and HB23-1171, requiring a reason for non-renewal of a lease agreement – were postponed indefinitely. However, here are a few lesser-known bills that did pass this year:

- HB23-1095 – Prohibited Provisions in Rental Agreements. Led by 9to5 Colorado, this law prohibits certain provisions in rental agreements. No longer will tenants be required to sign leases which include a fee for being evicted, a prohibition on class action suits, a penalty for failure to provide notice for nonrenewal of a lease beyond actual losses, eviction for non-payment of utilities alone if a landlord operates on a voucher or subsidy program, and more.

- SB23-184 – Protections for Residential Tenants. Led by Colorado Coalition for the Homeless and Colorado Poverty Law Project, this new law prohibits the requirement that a tenant’s income exceed two times of rent. Many landlords currently require a tenant have income three times that of their rent. While it is not ideal to have to spend more than 30% of one’s income on rent, half of Colorado renters do.[iv] This bill also limits the security deposit that is over two monthly rent payments and allows a tenant to assert an affirmative defense to an eviction hearing that the landlord violated anti-discrimination housing laws.

- HB23-1120 – Eviction Protections for Residential Tenants. Led by Disability Law Colorado and Colorado Cross-Disability Coalition, this new law protects those who self-identify as recipients of Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), or Temporary Assistance to Needy Families (TANF). The law requires landlords who have more than five single family homes and more than five rental units including any single family homes to mediate prior to filing for eviction. Such a tenant will now be given 30 days to move if evicted, giving them a better opportunity to mitigate challenges related to finding low-income housing and/or units that meet their mobility needs.

Sadly, there was another bill which passed the Colorado legislature, but which was vetoed by Governor Jared Polis after the end of the legislative session: HB23-1190, Affordable Housing Right of First Refusal. Led by Colorado Poverty Law Project, CCLP was a key stakeholder and actively lobbied the bill in the Senate. The measure would have allowed local governments a right of first refusal to match an offer on a multi-family unit of 15 or more units in urban areas or five or more units in rural areas. To preserve affordability, such units would have been allowed to increase rent at the rate of inflation, preserving affordability. The bill would have been the first statewide law of its kind in the nation.

Zoning and low-cost housing

Beyond our support of tenant’s rights, CCLP recognizes the need to preserve low-cost housing and to create housing that is affordable, especially to those with very low incomes (i.e., those with income(s) below 30% of the Area Median Income.) Between 2010 and 2019, Colorado has seen its stock of units that rent for less than $600 per month shrink by over 40%.[v] New housing is rarely created for those whose income is less than $25,000 per year without a government subsidy for the developer.

CCLP has been researching and evaluating best practices that focus on zoning, land use, and planning as a strategy to increase our supply of affordable rental housing. CCLP encourages practices which will lead to the development of housing for people who have been or could be priced out of housing, to reduce racial segregation of neighborhoods, and to increase density while avoiding the gentrification or displacement of current residents.

As a member of a multi-interest statewide coalition related to reforming land use and zoning policies in Colorado to address conservation, climate change, and lower housing costs, CCLP helped developed a set of legislative proposals that would require local governments to study and plan for future housing needs across all income levels, increase density around transit stations, and legalize housing types such as duplexes, that local governments make illegal to build in many of our detached single-family housing neighborhoods across our state.

This proposal informed the Governor’s own Land Use proposal, SB23-213, which incorporated many of these ideas. It did not explicitly require any level of affordability for new housing created; however, it would have required local governments to adopt policies to encourage the construction of housing affordable to low-income Coloradans, in addition to policies to discourage displacement. Some policies of the introduced bill could have had the unintended consequence of exacerbating displacement of longtime residents, a concern CCLP shared.

Ultimately, the governor’s bill was postponed indefinitely on the last day of session, primarily due to opposition from local governments who viewed it as a state “power grab” of what has been local control of most land use and zoning decisions. Nevertheless, we are glad to see the public discussion of the barriers that land use and zoning place on housing affordability, equitable access, and even general housing availability. CCLP looks forward to continuing to advocate for policies that expand the supply of affordable housing for working families in Colorado in a way that does not risk displacing these same folks from their current neighborhoods.

Stay tuned for Part 2 of our legislative wrap-up, where we’ll take a look at big changes for patients and Coloradans struggling to pay high medical bills!

[i]https://leg.colorado.gov/sites/default/files/initiative%2520referendum_proposition%20121%20final%20lc%20packet.pdf

[ii] https://copolicy.org/resource/overlooked-and-undercounted-2022/

[iii] https://nlihc.org/housing-needs-by-state/colorado

[iv] https://www.chfainfo.com/getattachment/cad06816-f243-4218-b438-65df4c903f44/WP_HousingAffordabilityGap.pdf

[v] https://copolicy.org/wp-content/uploads/2022/04/220308-Low-Cost-Housing-in-Colorado-Issue-Brief.pdf