A summary of the list of recommendations on the implementation of the OBBBA in Colorado regarding public benefits systems and work requirements.

Recent articles

CCLP testifies in support of Colorado’s AI Sunshine Act

Charles Brennan provided testimony in support of Senate Bill 25B-004, Increase Transparency for Algorithmic Systems, during the 2025 Special Session. CCLP is in support of SB25B-004.

Coloradans launch 2026 ballot push for graduated state income tax

New ballot measure proposals would cut taxes for 98 percent of Coloradans, raise revenue to address budget crisis.

CCLP statement on the executive order and Colorado’s endless budget catastrophe

Coloradans deserve better than the artificial budget crisis that led to today's crippling cuts by Governor Jared Polis.

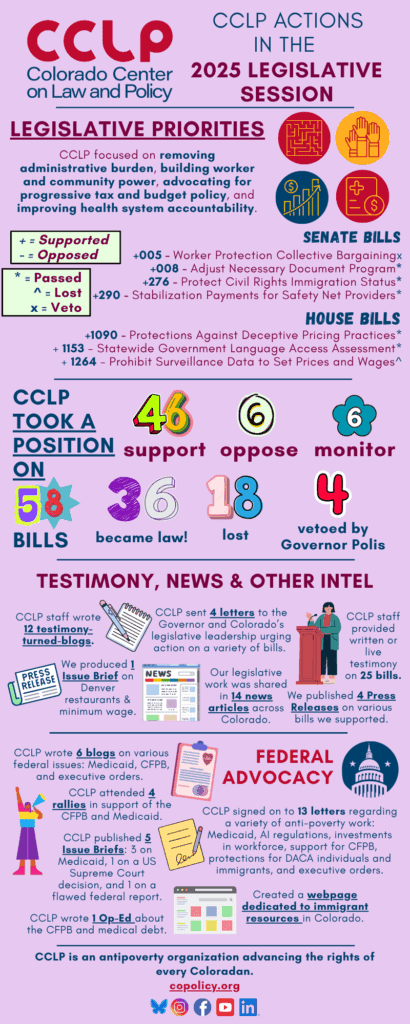

CCLP’s 2025 legislative wrap-up, part 2

Building worker and community power

This year, CCLP supported building community power by amplifying Coloradans’ voices in the workplace and civic life. Most of the positions we took on bills landed in this category, including four of our priority bills: SB25-276, HB25-1090, HB25-1153, and HB25-1264.

SB25-276, Protect Civil Rights Immigration Status, brought by Colorado Immigrant Rights Coalition, strengthens Colorado’s existing laws by closing data privacy loopholes, fortifying constitutional protections for immigrants at public locations like hospitals, schools, and childcare centers, and by prohibiting local law enforcement from honoring ICE detainer requests without a judicial warning.[1] This legislation reaffirms our state’s commitment to upholding the civil liberties of all residents, and fostering a more just and safe community for everyone, regardless of immigration status.

HB25-1090, Protections Against Deceptive Pricing Practices, protects Colorado consumers from deceptive “junk fees” — those hidden, mandatory charges that some businesses and landlords add to the advertised price of goods and services. Some examples of junk fees include resort fees at hotels, processing or administrative fees, and mandatory service charges. This is a good bill, but it was weakened by eliminating “private right of action” — your right to question hidden fees through demand letters and to take direct action when a business or landlord violates the law. Chris Nelson, CCLP’s Research & Policy Analyst, provided testimony in support of the bill.

HB25-1153, Statewide Government Language Access Assessment, requires Colorado agencies to assess language access services and create a statewide language access policy. Language access helps Coloradans who speak different languages communicate with one another and receive important information in a way they understand. Language access can be spoken, signed, or written.[2] CCLP co-led this bill with Spring Institute of Intercultural Learning, and jointly-released a press release in response to the bill passing, which you can read here. Morgan Turner, CCLP’s Community Engagement Director, provided testimony in support of the bill.

We also supported SB25-020, Tenant and Landlord Law Enforcement, which gives local communities and the Attorney General the power to enforce landlord-tenant housing laws. Additionally, HB25-1001, Enforcement Wage Hour Laws, expands enforcement of wage and hour laws, ensuring Colorado workers are paid the wages they have worked and earned, further protecting and supporting Colorado’s workforce. Chris Nelson provided testimony in support of the bill. HB25-1010, Prohibiting Price Gouging in Sales of Necessities, is a new Colorado consumer protection prohibiting “price gouging,” — a price increase of 10% or more — on essential goods and services, in emergency situations. Things like groceries or sanitary products are considered essential for the health and safety of the public, and are banned from price gouging.

A bill we opposed but still became law is HB25-1208, Local Governments Tip Offsets for Tipped Employees, which claims to let local governments establish lower minimum wages for tipped workers. In reality, the law cuts wages for tipped workers and increases wage theft. According to our Issue Brief: Denver Restaurants and Minimum Wage, a regular server in Denver could lose $3,220 to $4,000 in income for this year. Charles Brennan, CCLP’s Income and Housing Policy Director, provided testimony in opposition of the bill.

Advocating for progressive tax and budget policy

Along with other fiscal-focused partners, including the Bell Policy Center and Colorado Fiscal Institute, CCLP supported bills advocating for progressive tax and budget policies allowing for investment in public programs and critical infrastructure.

One such bill, SB25-173, Revenue Classification for Taxpayers Bill of Rights, clarifies TABOR exemptions — “damage award” and “property sale” — preventing these revenues from being subject to TABOR spending limits. This allows Colorado to retain some funding flexibility. HB25-1296, Tax Expenditure Adjustment, also retained some state funding by adjusting several of Colorado’s tax expenditures to provide more flexibility to our already constrained budget. Additionally, HB25-1274, Healthy School Meals for All Program aims to secure funding to provide free healthy school meals for all public-school students. To further fund this program, Colorado voters will consider two ballot issues in November 2025 that would reduce tax deductions for high-income individuals — anyone making more than $300,000 a year.

In the effort to advocate for progressive tax and budget policies, we opposed SB25-138, Reductions to State Income Tax, which would have lowered our income tax rate from 4.4% to 4.25% for tax years 2025-2034 and eliminate the state income tax altogether for tax year 2035 and beyond. The bill lost in its first committee, proving that income tax rate cuts provide no benefit to the majority of our population. Chaer Robert provided testimony in opposition to the bill.

Improving health system accountability

This session, CCLP aimed to keep the health care industry accountable, ensuring they provide Coloradans with the care and coverage they need, and honoring their commitment to the public good. We had one of our priority bills in this section, SB25-290, Stabilization Payments for Safety Net Providers, brought forward by the Save Our Safety Net coalition. It creates a plan to help stabilize a broad cross-section of safety net providers that have been struggling in the wake of the Medicaid coverage losses. The Provider Stabilization Fund brings together available state funding, private contributions, and a federal match to facilitate payment to qualifying clinics in Fiscal Year 2025-26.

One of the first laws passed this year was HB25-1002, Medical Necessity Determination Insurance Coverage, which makes behavioral, mental health and substance use treatment have the same coverage as physical health treatment including prevention, screening, and treatment. This ensures fair standards for mental health coverage, so Coloradans get the life-saving services they’re already paying for.[3] CCLP provided testimony in support of the bill. HB25-1309, Protect Access to Gender-Affirming Health Care, also requires health insurance plans to cover medically necessary gender-affirming health care. It prohibits insurance discrimination and protects patient privacy for transgender and gender-diverse people.

To many health advocates’ delight, SB25-045, Health-Care Payment System Analysis, allows for analysis of a model for a single-payer universal health care system for Colorado and must report its findings to the legislature by the end of 2026. The goal is to gather information on how we could have a universal, state-financed health care system that would work for all Coloradans. We also supported HB25-1017, Community Integration Plan Individuals with Disabilities, which seeks to help people with disabilities participate in their communities more fully by providing services and programs in inclusive community settings. Bethany Pray, CCLP’s Chief Legal and Policy Officer, provided testimony in support of the bill.

Because of concerning federal changes, SB25-196, Insurance Coverage Preventative Health-Care Services, creates a state-level system to identify preventative services that must be covered in Affordable Care Act (ACA) plans, in the event federal litigation takes away the process established by the ACA. This ensures Coloradans will continue to get the necessary health care they need and deserve.

Other bills

The following bills we took positions on, but the parameters fell outside of our four priorities. We were successful in opposing two bills with anti-immigration rhetoric that died in committee: SB25-047, Enforcement of Federal Immigration Law, aimed to bring back Colorado’s “Show Me Your Papers” law, under the guise of only allowing eligible citizens to vote, SB25-057, Noncitizen Voter Registration Cancellation, would have allowed for data sharing to federal immigration officers, likely resulting in the deportation of undocumented individuals. Milena Tayah, a Policy Advocate at CCLP provided testimony in opposition of the bill.

On the opposite end, we supported two laws that increase visitation rights for incarcerated people in correctional facilities in Colorado, HB25-1013, Department of Corrections Visitation Rights, and for the creation of the Colorado Defense Fund, HB25-1321, Support Against Adverse Federal Action. It sets aside $4 million to protect Coloradans from federal changes to freeze our state’s allocated funding or disrupt essential services, a move Democrats are calling, “Musk-proof,” [4] to safeguard against any type of retaliation Colorado could see should the state defy the president’s executive orders.

Click here to read CCLP’s 2025 legislative wrap-up, part 1.

Click here to read CCLP’s 2025 legislative wrap-up part 3.

**********

[1] https://coloradoimmigrant.org/wp-content/uploads/2025/04/SB25-276-Fact-Sheet-.pdf

[2] https://www.canva.com/design/DAGdfzZuCYI/PdWSoWsxBIRt9UOhm1zNOw/view?utm_content=DAGdfzZuCYI&utm_campaign=designshare&utm_medium=link&utm_source=viewer

[3] https://drive.google.com/file/d/1q4JoX0nVra4dwzO91Wt3WdYZ82PifGIj/view

[4] https://www.senatedems.co/newsroom/senate-approves-legislation-to-create-the-colorado-defense-fund